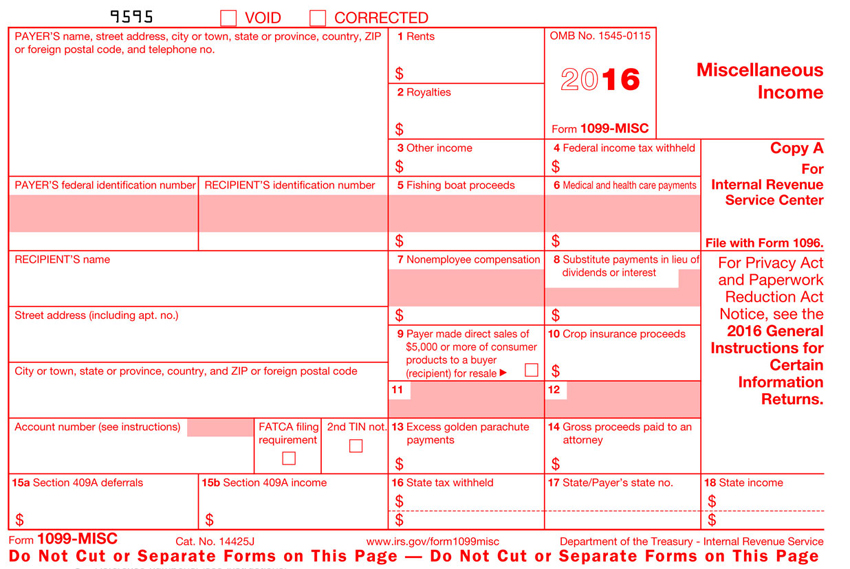

Issuing 1099 forms is probably one of the more confusing tax topics for small business owners. Businesses are required to issue 1099s to certain vendors and contractors to whom the business made payments of more than $600. The 1099 is

1099 Forms – Who, What, When, & How