The holidays season is relaxing break from work and opportunity to spend some time with family and friends. It is also a great time to reflect on all your blessing and to help those less fortunate than you. If you

Guide to Charitable Donations

The holidays season is relaxing break from work and opportunity to spend some time with family and friends. It is also a great time to reflect on all your blessing and to help those less fortunate than you. If you

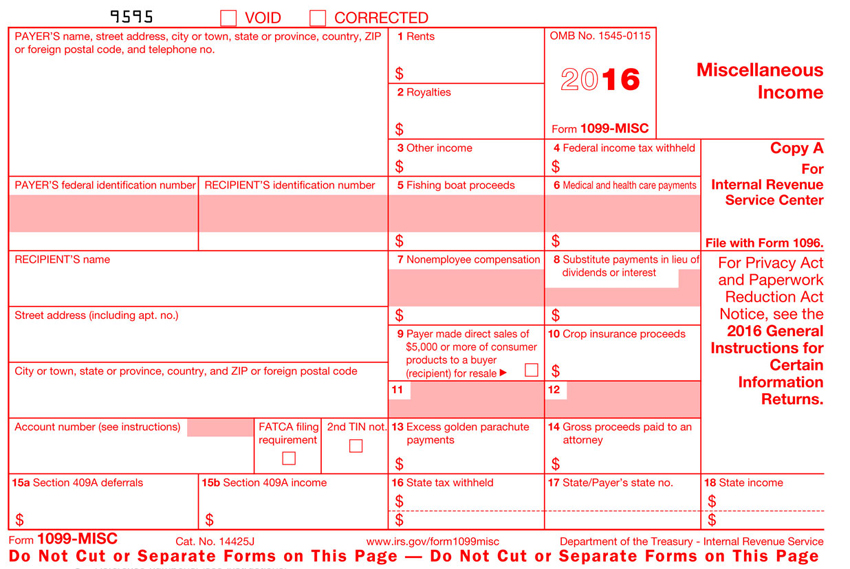

Issuing 1099 forms is probably one of the more confusing tax topics for small business owners. Businesses are required to issue 1099s to certain vendors and contractors to whom the business made payments of more than $600. The 1099 is

Happy 2017! While we’re gearing up for the current tax season, it’s important to plan ahead for next year as well. Below are some of the key changes to IRS rates and limits for this tax year. Please note these

Tax identity theft occurs when a fraudster gains access to your Social Security Number (SSN) and/or other personal details and uses it to file a fraudulent tax return on your behalf and collect the refund. While the IRS has safeguards

This year, you may receive a new tax form outlining details of the healthcare coverage you and your dependents had in 2015. These forms are used to support the Individual Shared Responsibility Provision of the Patient Protection and Affordable Care